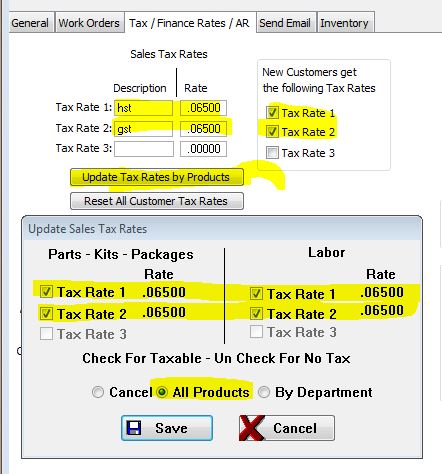

Sales Tax Rates

Enter each tax description and rate. This is mainly applicable to Canada.

New Customers get the Following Tax Rates

Check all that apply for New Customers

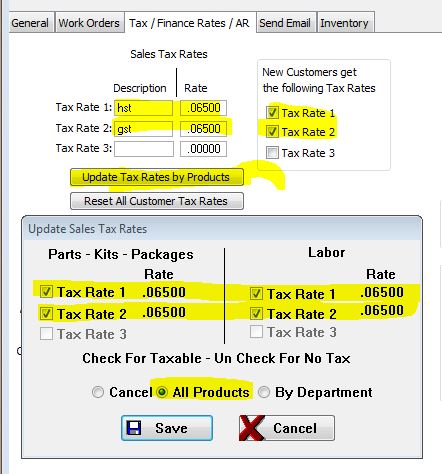

Changing Tax Rate to Dual Tax Rates

1. Make your tax rates changes and SAVE the Configuration. The go back to Global > Tax Rates

2. Click on Update Tax Rates by Products

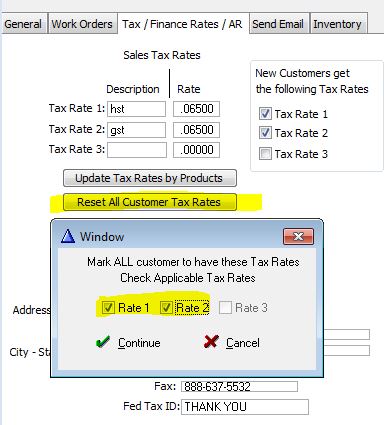

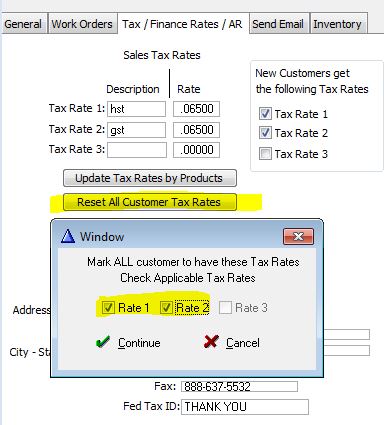

3. Click on Reset All Customer Tax Rates

If you go back to 1 Tax Rate, you must do these steps again.

The tax rates will not change for existing Work Orders, only New ones.

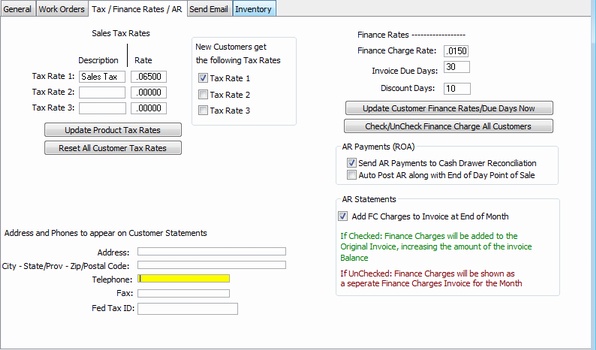

Address to Appear on Customer Statements.

If your remittance address is different from you normal business address, enter the address that you want

your customer's to send their payments to.

Finance Rates

Enter the Finance Rate for Overdue customer accounts.

Click this button to cascades changes to finance rate to your customer data base

Resets Customer Tax Rates to one or ALL rates

Send AR Payments to Cash Drawer Reconciliation:

Payments on Acct will print at End of Day and show on Cash Reconciliation Report.

Remember that the payment will show on the AR posting and on the Cash Reconciliation Report.

Auto Post AR Along with End of Day Point of Sale

|